How Fine wine grows in value

Why Does Fine Wine Increase in Value?

Fine wine is unique because it generally becomes more valuable over time. Here’s why:

- Rarity: As bottles from a vintage are consumed, the remaining supply decreases. This scarcity drives prices up, making rare wines more valuable.

- Aging Process: Fine wines improve with age, developing more complex flavors. As they reach their peak drinking window, their value can increase significantly.

- Producer Reputation: Wines from iconic producers like Bordeaux's Château Margaux are in constant demand. These producers have a track record of quality, which adds value to their wines over time.

- Vintage Quality: Wines from exceptional growing seasons tend to appreciate faster. Quality vintages from renowned regions can command premium prices and are highly sought after by collectors and investors.

Why is Fine Wine a Stable Investment?

Unlike stocks or real estate, fine wine tends to remain stable even when markets fluctuate. Here’s why:

- Low Correlation with Traditional Markets: Wine’s value doesn’t typically move with the stock market, which makes it a great diversification tool. When markets are volatile, wine remains a steady investment.

- Consistent Demand: Wine is a consumable product, and once a bottle is consumed, it’s gone. This constant demand keeps prices stable and ensures that there is always a market for fine wine.

- Cultural and Historical Value: Fine wine holds cultural and historical significance, making it appealing beyond financial gain. Its status as a luxury good also helps sustain demand in growing markets.

What Are the Risks?

Like all investments, fine wine comes with risks. Here are a few to consider:

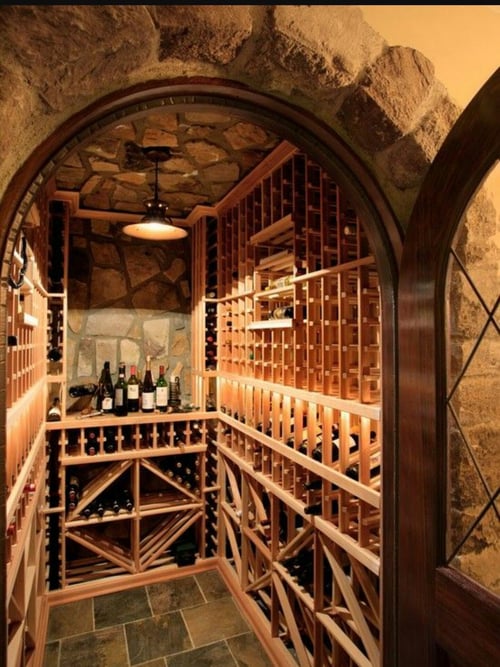

- Storage: Wine must be stored in specific conditions to maintain its quality. Poor storage can ruin a wine’s value. That’s why professional storage is essential.

- Liquidity: Selling fine wine isn’t as straightforward as selling stocks, but Meza is working to create a more liquid secondary market. This will help investors buy and sell their collections more easily.

At Meza, we manage the storage of your wines and provide expert guidance to ensure that your investment stays protected and retains its value.

Meza’s Approach to Wine Investment

At Meza, we use data-driven insights to help select wines with the best growth potential. Our team carefully chooses collections from top producers and vintages. Plus, we handle the storage and management, so you don’t have to worry about preserving your wine’s value.

(Disclaimer: As with all investments, capital is at risk, and the value of your investments may go down)

Conclusion:

Fine wine is a rewarding investment, offering both financial returns and personal satisfaction. Its stability, combined with the potential for long-term appreciation, makes it a great option for investors looking to diversify their portfolios.